There are many things you should consider when buying a house. It is important to save money for your down payment, look for a house that is close to good schools, and ensure that the house's mechanics are in good condition. You'll also want to look at the neighborhood's culture and local businesses. Make sure you have enough money to pay the mortgage. It's not a good idea to buy a house that is too expensive.

You can save for a down payment

FDIC-insured savings accounts can be a great place to save for a downpayment. These accounts have higher than average interest rates and are easy to access. For those who are planning to buy a long-term home, it may be more practical to invest in the market. The potential for higher returns can make sense.

Start by calculating your income. Start by calculating your monthly income and adding in the income of your spouse if you have one. You can review your bank statements or credit card bills.

Locating a house in an area with good schools

The location of a school is an important factor in buying a home. However, it is not the only thing that is important. It is also important to consider factors like commute time and school quality. It is important to consider all these factors and to be open to making sacrifices or giving up some features.

First, it is important to find a property in a great school district if you are buying a home for yourself or your family. This will make it more attractive and easier to sell. A good school district is a must if you are considering purchasing a house for your kids. Special provisions may be made available for students with special needs in some school districts.

Get a home inspection

A home inspection is essential before buying a house. This gives you a feeling of ownership and helps you negotiate the price. It's usually worth closing on a well-maintained house. However, if the home needs work, the inspector's reports can help you negotiate a better price or convince the seller to fix it.

If you find significant problems in your home, such a leaky water heater or other major issues, you may be able negotiate with the seller for repairs or a lower price. If you aren't willing to pay for repairs, you can walk away from the agreement. Often, sellers will agree that a home inspector is part of the sales contract.

FAQ

What are the chances of me getting a second mortgage.

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

Can I buy a house in my own money?

Yes! There are many programs that can help people who don’t have a lot of money to purchase a property. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. Visit our website for more information.

How can I get rid Termites & Other Pests?

Over time, termites and other pests can take over your home. They can cause serious damage and destruction to wood structures, like furniture or decks. A professional pest control company should be hired to inspect your house regularly to prevent this.

What can I do to fix my roof?

Roofs may leak from improper maintenance, age, and weather. Roofers can assist with minor repairs or replacements. Contact us for further information.

Is it possible to sell a house fast?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. But there are some important things you need to know before selling your house. First, you must find a buyer and make a contract. Second, prepare your property for sale. Third, it is important to market your property. You must also accept any offers that are made to you.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

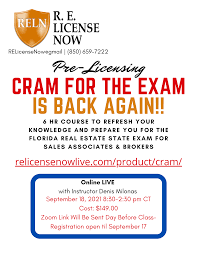

How to become a broker of real estate

Attending an introductory course is the first step to becoming a real-estate agent.

Next you must pass a qualifying exam to test your knowledge. This involves studying for at least 2 hours per day over a period of 3 months.

After passing the exam, you can take the final one. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

All these exams must be passed before you can become a licensed real estate agent.