Here are some tips to maximize your real estate investment returns. Find out what properties you are allowed to invest in. The article will also address the importance asset protection, location, and refinancing properties. These tips can help you to maximize your investment success. This article will prove especially helpful if you're a first investor or are looking to purchase multiple properties.

Investment properties

Why are investment properties attractive for real estate investors? The answer will depend on your personal goals and the market where you live. It also depends on how you invest. There is no definitive answer to these questions. Therefore, it is important that you weigh the pros and disadvantages of each investment option. It is also important to consider where you are located. Investors in "up and coming" markets might be more inclined to invest in vacant land while investors in mature markets might be more interested residential properties.

Protection of assets

There are several strategies that you can use to protect your assets if you're serious about real estate investing. Real estate investors typically use landlord insurance, with a small amount of debt. However, it is possible to protect your assets by holding real estate in an LLC/trust. You should also consider how much equity you've built up in your properties. Ultimately, the best strategy will depend on your goals, investments, and risk tolerance.

Localization

Real estate investing depends on location. This will impact the return on your investment. Although cheaper properties are not as profitable as more expensive properties, it is important to take into account the neighborhood. Some neighborhoods are booming, and others may not be the best investments. If you are unsure whether the property is right for your needs, take into account the area's affordability. Be sure to thoroughly inspect the property before you make a decision.

Refinance existing properties

For real-estate investors, refinancing existing properties allows you to benefit from lower interest rates as well as lower monthly payments in order to maximize your investment. Refinance your existing properties will allow you to use the equity that has been built to the property to improve or finance other investment properties. It's an attractive option for investors because it may offer tax deductions. There are several steps involved. Here's how to get started:

Manage your own portfolio

There are many things to consider when starting your own real-estate portfolio. The right asset allocation will depend on your goals, risk tolerance, and risk tolerance. You will need to take greater risks if you want higher returns. However, investors who are looking to earn a steady and predictable income will choose to invest in safer assets. A more aggressive real estate portfolio will generally be associated with a greater risk tolerance. How can you pick which investments to make, however?

FAQ

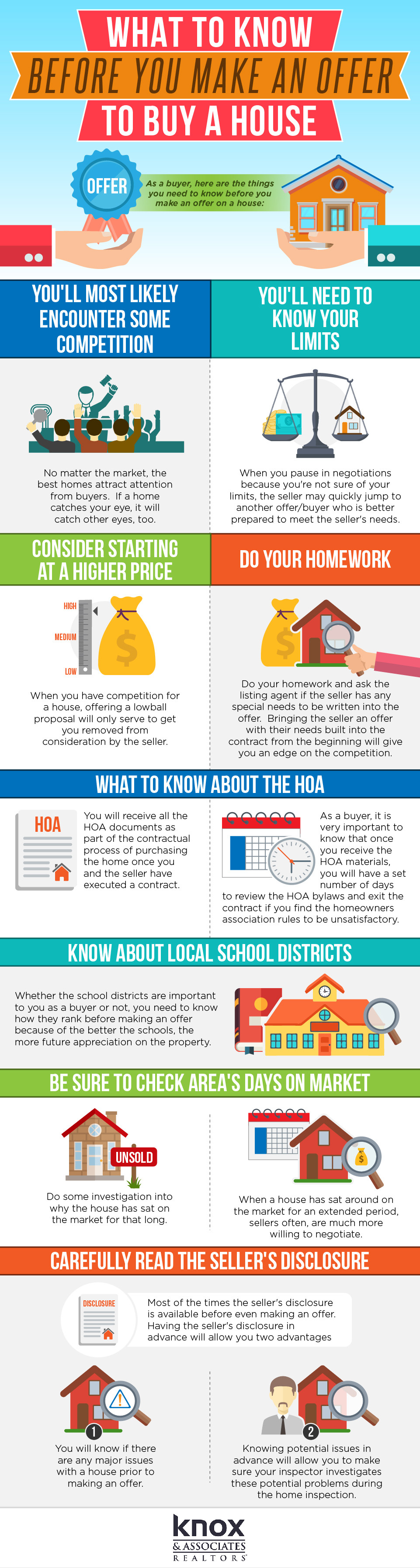

What should I do before I purchase a house in my area?

It all depends on how many years you plan to remain there. If you want to stay for at least five years, you must start saving now. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

Should I use a mortgage broker?

A mortgage broker may be able to help you get a lower rate. Brokers work with multiple lenders and negotiate deals on your behalf. Some brokers earn a commission from the lender. Before signing up for any broker, it is important to verify the fees.

Which is better, to rent or buy?

Renting is generally cheaper than buying a home. But, it's important to understand that you'll have to pay for additional expenses like utilities, repairs, and maintenance. A home purchase has many advantages. You will be able to have greater control over your life.

Can I get a second mortgage?

Yes. However it is best to seek the advice of a professional to determine if you should apply. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

How can I calculate my interest rate

Market conditions can affect how interest rates change each day. The average interest rate during the last week was 4.39%. To calculate your interest rate, multiply the number of years you will be financing by the interest rate. For example, if you finance $200,000 over 20 years at 5% per year, your interest rate is 0.05 x 20 1%, which equals ten basis points.

What are the advantages of a fixed rate mortgage?

Fixed-rate mortgages allow you to lock in the interest rate throughout the loan's term. You won't need to worry about rising interest rates. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How to Buy a Mobile Home

Mobile homes are homes built on wheels that can be towed behind vehicles. Mobile homes are popular since World War II. They were originally used by soldiers who lost their homes during wartime. People who live far from the city can also use mobile homes. Mobile homes come in many styles and sizes. Some houses are small while others can hold multiple families. There are some even made just for pets.

There are two main types for mobile homes. The first type is manufactured at factories where workers assemble them piece by piece. This happens before the product can be delivered to the customer. The other option is to construct your own mobile home. First, you'll need to determine the size you would like and whether it should have electricity, plumbing or a stove. Next, make sure you have all the necessary materials to build your home. Final, you'll need permits to construct your new home.

These are the three main things you need to consider when buying a mobile-home. Because you won't always be able to access a garage, you might consider choosing a model with more space. Second, if you're planning to move into your house immediately, you might want to consider a model with a larger living area. You should also inspect the trailer. You could have problems down the road if you damage any parts of the frame.

Before you decide to buy a mobile-home, it is important that you know what your budget is. It is important that you compare the prices between different manufacturers and models. Also, take a look at the condition and age of the trailers. Many dealers offer financing options. However, interest rates vary greatly depending upon the lender.

A mobile home can be rented instead of purchased. Renting allows you the opportunity to test drive a model before making a purchase. Renting isn’t cheap. The average renter pays around $300 per monthly.