Real estate taxes are applied to residential and commercial property in order fund public infrastructures such as schools, water, roads and parks repair. Property taxes are based on the assessed value of your home and land, and can vary greatly by region.

How to Calculate Your Taxes

The rate of property tax in your area and state will vary so there is no one formula that can accurately calculate your annual property bill. For more information, contact your local government or a tax attorney.

The IRS typically charges a percentage of income to real estate agents each year. This can make it difficult to figure how much you owe. There are some tips and tricks to help you calculate taxes more accurately.

First, you must know how to find your assessed home and land value. This number can be found in your annual tax notice, at your local tax assessor's office or on the website of your city or county.

Next, multiply that number by a rate of tax assessment and you can calculate your property taxes. The tax rate varies from one jurisdiction to the next and can range anywhere from a few thousand dollars to a percentage like 4%.

You can also use a free tool like the SmartAsset property-tax calculator to get an idea of your tax bill. This tool will give you an estimate of how much your property tax will be based upon the assessed value your home as well as any additional properties such as land.

How do real estate agents pay their taxes?

Real estate agents also have to pay property taxes. This includes both the property and any personal belongings, like cars or boats, that are stored on the property.

A real estate company is not an entity, so each year the owner must file their tax return. This can be a complicated process, and it's important to work with a professional to ensure you are filing your tax returns correctly.

How to deduct expenses from your Real Estate Profits

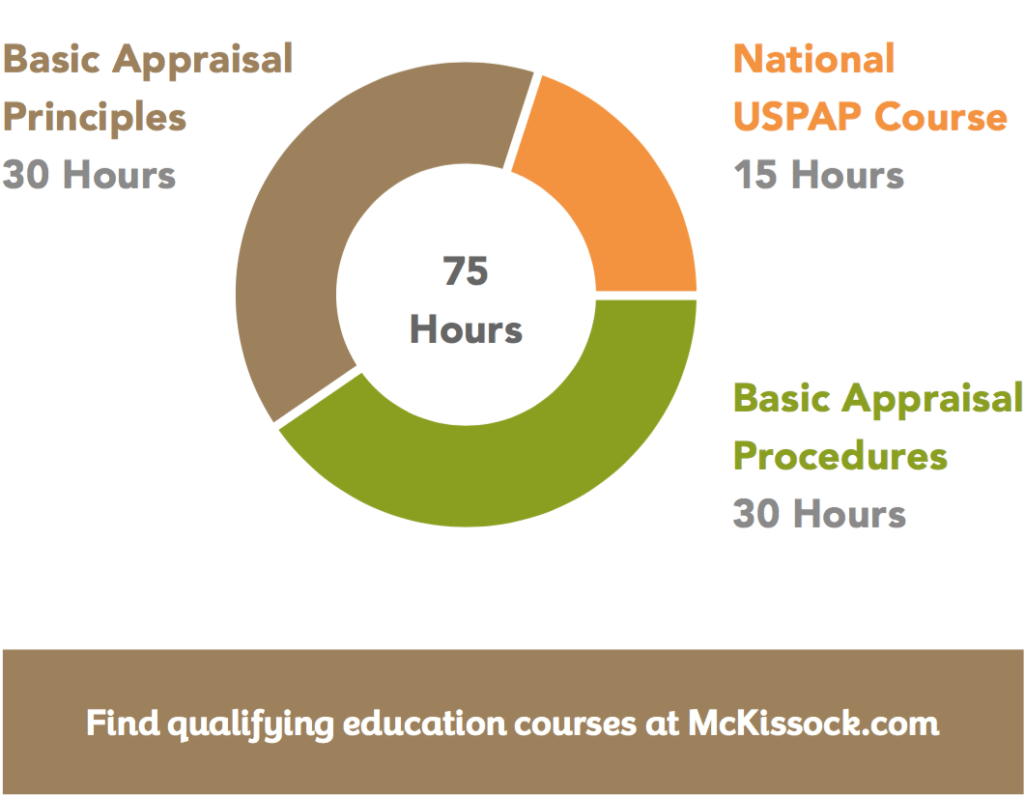

One of the most important ways that real estate investors can save money at tax time is by making sure they take advantage of all available deductions. This could include, among others, appraisal fees, real property commissions, advertising costs, and insurance.

Another key way that real estate investors can save on their taxes is by keeping proper records. This includes documents such as business cards, receipts from purchases made for your business, and other expenses that are related to your realty career.

Real estate professionals have a number of tax advantages, including the loss deductibility of their real estate investments and exemption from the 3.8 per cent Medicare tax on unearned Income. This tax break can help real estate agents and brokers earn more money while maintaining a healthy financial position.

FAQ

What are the 3 most important considerations when buying a property?

The three most important things when buying any kind of home are size, price, or location. It refers specifically to where you wish to live. Price refers to what you're willing to pay for the property. Size refers how much space you require.

How do I calculate my interest rate?

Market conditions can affect how interest rates change each day. In the last week, the average interest rate was 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. Example: You finance $200,000 in 20 years, at 5% per month, and your interest rate is 0.05 x 20.1%. This equals ten bases points.

Is it possible for a house to be sold quickly?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. There are some things to remember before you do this. First, you will need to find a buyer. Second, you will need to negotiate a deal. You must prepare your home for sale. Third, you must advertise your property. Finally, you should accept any offers made to your property.

How can I tell if my house has value?

If your asking price is too low, it may be because you aren't pricing your home correctly. Your asking price should be well below the market value to ensure that there is enough interest in your property. To learn more about current market conditions, you can download our free Home Value Report.

How long does it usually take to get your mortgage approved?

It depends on several factors such as credit score, income level, type of loan, etc. Generally speaking, it takes around 30 days to get a mortgage approved.

How much money do I need to save before buying a home?

It depends on how much time you intend to stay there. Save now if the goal is to stay for at most five years. You don't have too much to worry about if you plan on moving in the next two years.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to purchase a mobile home

Mobile homes are houses constructed on wheels and towed behind a vehicle. They have been popular since World War II, when they were used by soldiers who had lost their homes during the war. People today also choose to live outside the city with mobile homes. These houses are available in many sizes. Some houses have small footprints, while others can house multiple families. You can even find some that are just for pets!

There are two main types mobile homes. The first is built in factories by workers who assemble them piece-by-piece. This takes place before the customer is delivered. A second option is to build your own mobile house. First, you'll need to determine the size you would like and whether it should have electricity, plumbing or a stove. Next, ensure you have all necessary materials to build the house. The permits will be required to build your new house.

You should consider these three points when you are looking for a mobile residence. You may prefer a larger floor space as you won't always have access garage. You might also consider a larger living space if your intention is to move right away. The trailer's condition is another important consideration. You could have problems down the road if you damage any parts of the frame.

You need to determine your financial capabilities before purchasing a mobile residence. It is important to compare prices across different models and manufacturers. Also, take a look at the condition and age of the trailers. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

Instead of purchasing a mobile home, you can rent one. Renting allows you the opportunity to test drive a model before making a purchase. Renting isn't cheap. The average renter pays around $300 per monthly.